Books from “A Random Walk Down Walk Street” to “The Bare Foot Investor”, all expound the benefits of passive index investing. It is true that a superficial look at historical data for the S&P500 has shown that it has outperformed most active managers. However, a deeper look at other international indices as well as the fundamental drivers of index returns, show that this is a dubious assumption, and could have a detrimental effect to investors in the future.

There are several arguments against the assumption that stocks always go up, and therefore a passive index strategy is adequate for most investors:

1. Passive investing depends on active

As Mike Green of Thiel Macro, in order for passive investing to offer returns based upon economic growth, active investing has to help set somewhat realistic prices and the allocation of capital. The steady increase of passive investing has lead to passive flows now exceeding active flows for the first time in history, meaning that accurate pricing has started to breakdown. Consequently there has been a decrease in the marginal buyer, that will come in during market crashes and buy up undervalued companies. This has lead to embedded instability in the market, which could amplify crashes on the way down. Passive indexing and indescrete investing has become so pronounced that one Vegan ETF is basically primarily tech stocks. For a more detailed look, watch Michael’s talk on the subject:

2. Long term cycles favor different asset classes

In his paper “The 100 Year Portfolio” Chris Cole of Artemis Capital demonstrates that through extended periods of time strategies like index investing or a 60/40 portfolio are actually sub-optimal, and may even lose the majority of capital during certain periods. This is because there are cycles of credit creation, economic expansion/contraction, and inflation/deflation that occur over very long time periods of time. The period since the high inflation of the 1970s and the subsequent peak in interest rates has lead to a time when stocks and bonds have both performed well. A passive index of both of these may have been the most cost-effective way to participate in this phenomena, however we maybe very late in current debt supercycle, and about to turn to a period in which these strategies start to underperform.

3. First time in history peaking demographics

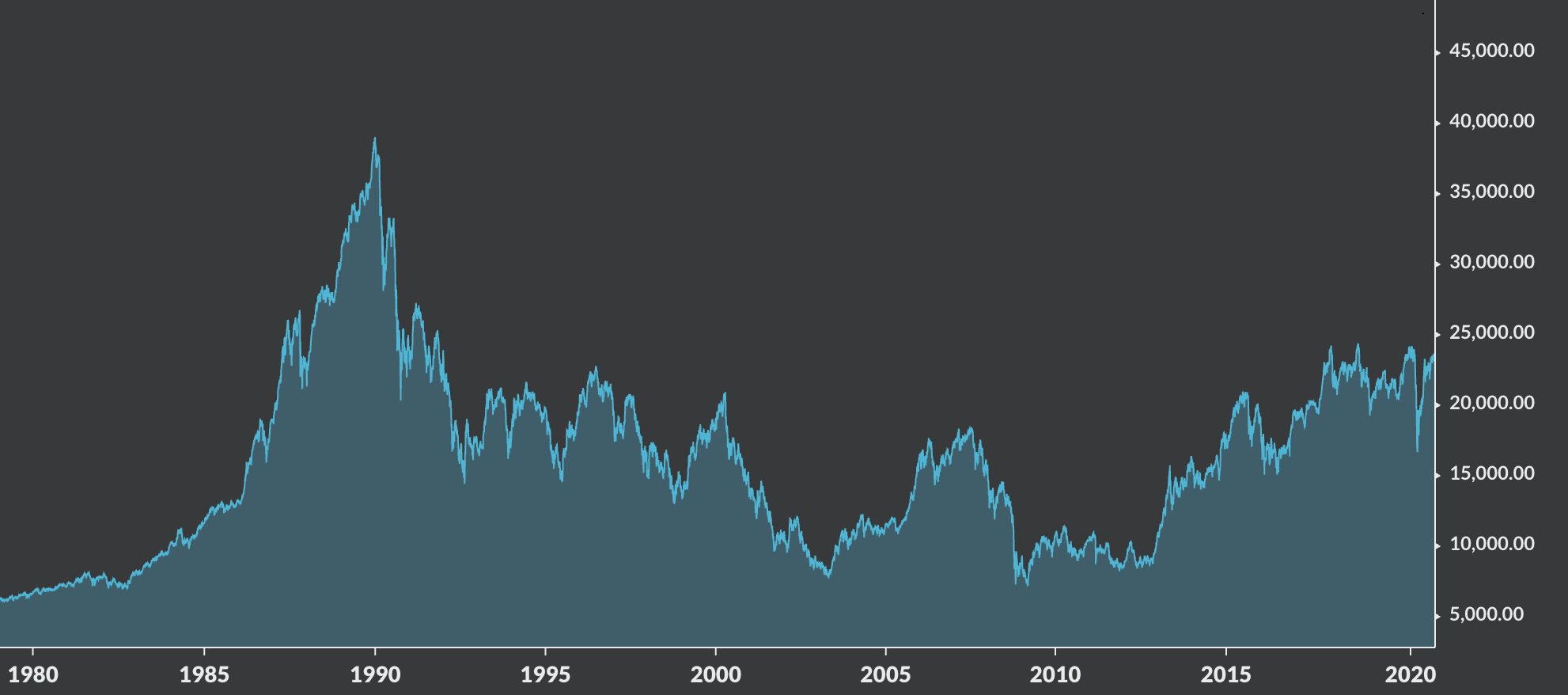

Finally, taking an even bigger look, we are arguably entering a unique period of history, that of peaking populations and aging demographics. Populations, contrary to popular opinion, do not grow exponentially but follow a logistics curve. This means that they eventually reach a peak and start to plateau. In countries whose demographics are a decade or so ahead of countries like the US, their stock indices and housing markets have failed to reach new highs. They go up and down with the business cycle, but now that their populations no longer support an ever-growing economy, to support bank credit expansion and asset price inflation, they only reach a succession of lower highs.

European Stoxx 50

Japanese Nikkei 225

Japanese House Price Index

Future Opportunities

Where then do future opportunities lie? In developed markets, it may be rotating into the asset classes that do well in next secular cycle along the lines of Chris Cole’s 100 year portfolio, whether that’s inflation, stagflation or even a longer term “Japanification” of the economy, or just learning to invest in the business cycle, rather than long the whole index. In emerging markets, it means looking to the economies that have demographics that will support future economic growth. For the next business cycle that’s likely to be India, sometime after that Africa. Finally, taking the lead from Japan, companies that offer significant productivity improvements, maybe the only place to find real economic growth, and so while those companies may succeed, ultimately that is even more deflationary for economies over burdened with debt and poor demographics.