From the US-China trade war to COVID highlighting the fragility of just in time supply chains, many people are calling for the end to globalisation and the nationalizing or at least regionalizing of supply chains.

Consensus is that this move would be at least mildy inflationary, as new factories have to be built, in higher costs areas with higher costs of labor. However, there are some arguments that while there may be short term inflation during the initial cap-ex spend, the eventual consequences may be deflationary.

- The infrastructure spend to fund the bringing home of supply chains will ultimately be funded by debt, either at the corporate or national level. This debt is on top of an already overly indebted economy, and lead to further deflation and slowing in the velocity of money.

- Much of the new capacity that will be built will be robotic and automated manufacturing, which may ultimately be lower cost than human labour, even in low-cost regions, especially once you factor in the decreased transportation costs for goods.

- While some of the reorganisation of supply chains will be regional, much of it will simply be moving out of China to even lower-cost places such as India or other places in Asia.

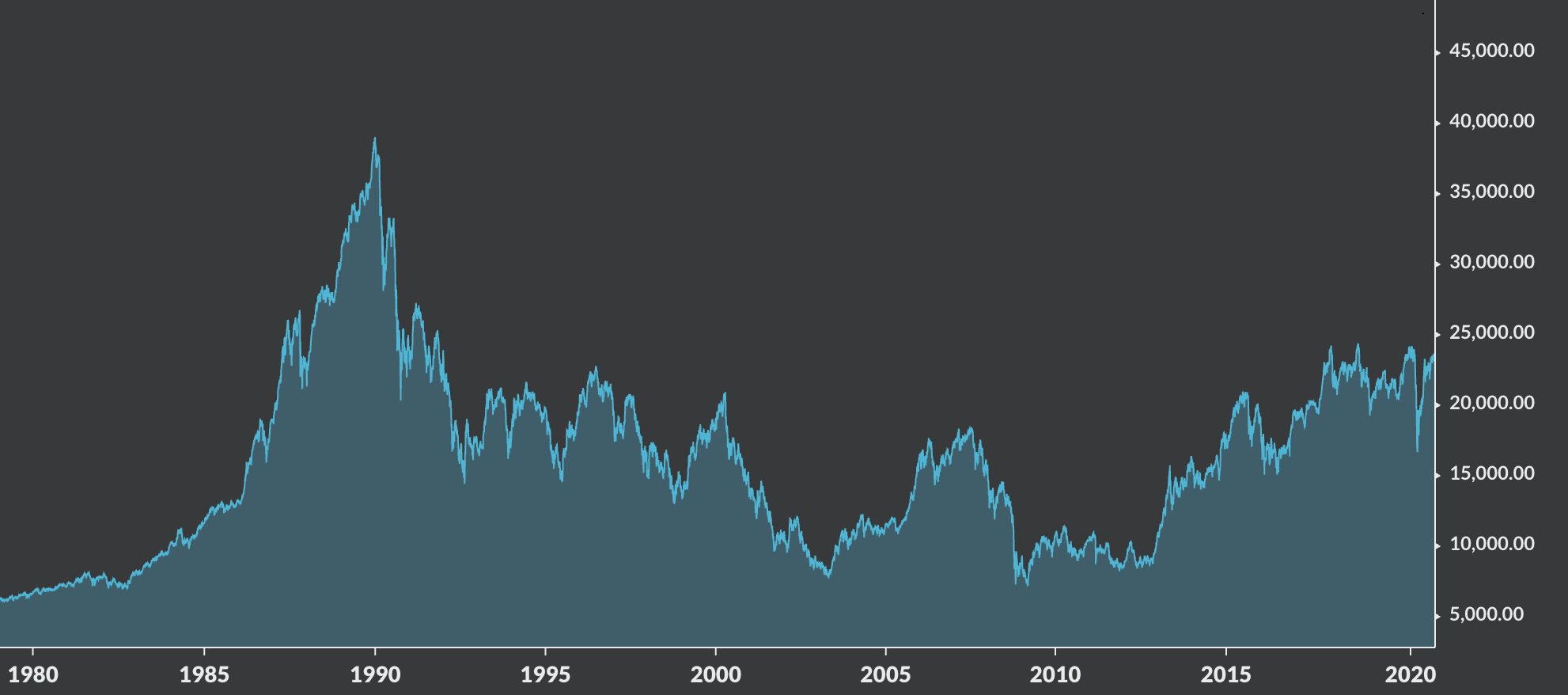

- As China sees slowing exports, and possible economic and societal destabilisation, they will likely let their currency weaken further to boost exports, exporting further deflation to the world.

- Once all the capacity has been built, we will ultimately have even more total manufacturing capacity in a world that arguable already has a excess capacity, meaning oversupply of goods, lower prices, and yet another deflationary pressure.