A recent thread on twitter from MMT proponent Stephanie Kelton got me thinking about the issue. The recent COVID stimulus funded by a massive deficit certainly has raised the question in a lot of people’s minds, though it was mainly papering over the cracks of a large amount of debt that wanted to deflate anyway.

If the goods and services available in an economy are roughly fixed, then MMT is way for the government to procure access to those goods and services through money printing instead of direct taxation. Is is therefore just another means of taxing the population and moving control of the economy from the free market to government. The issues with this idea are as follows:

- Is the government better at assigning the allocation of resources than the free market? History would suggest that in general, it is not, and much of what people describe as the recent failings of capitalism can be demonstrated to actually be caused by government intervention, not actions of the free market itself.

- The expansion of the money supply distorts prices because the unit of account is changed, this leads to misallocation of resources, promotion of financial engineering, and penalizing the responsible savers in a society. Arguably this has already been happening too.

- Wealth redistribution via government programs actually leads to decrease productivity and increased moral hazard, as it changes the behavior of members of an economy to be net takers rather than net contributors. Overall it would be better to create a fair system where work was rewarded better, rather than redistribution of wealth via the government.

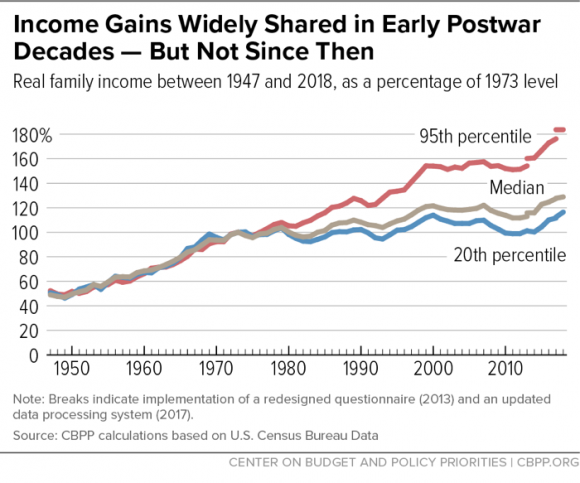

- Related to the previous point, money printing as a form of taxation is unfairly distributed. It keeps asset prices elevated, so taxes working-class wages and middle-class savings more than the assets of the rich. This is precisely what has been occurring through our expanding deficits and the increasing government control of the economy to get us to this point.

- Finally, deficits have to be paid back at some point. MMT is right in that this can be printed. The difference is that the deflationary forces of paying back the debt, through the full monetization that has been being priced in by gold since coming of the gold standard in 1971, finally turns to inflation.

For more check out this video with the legendary Lacy Hunt: