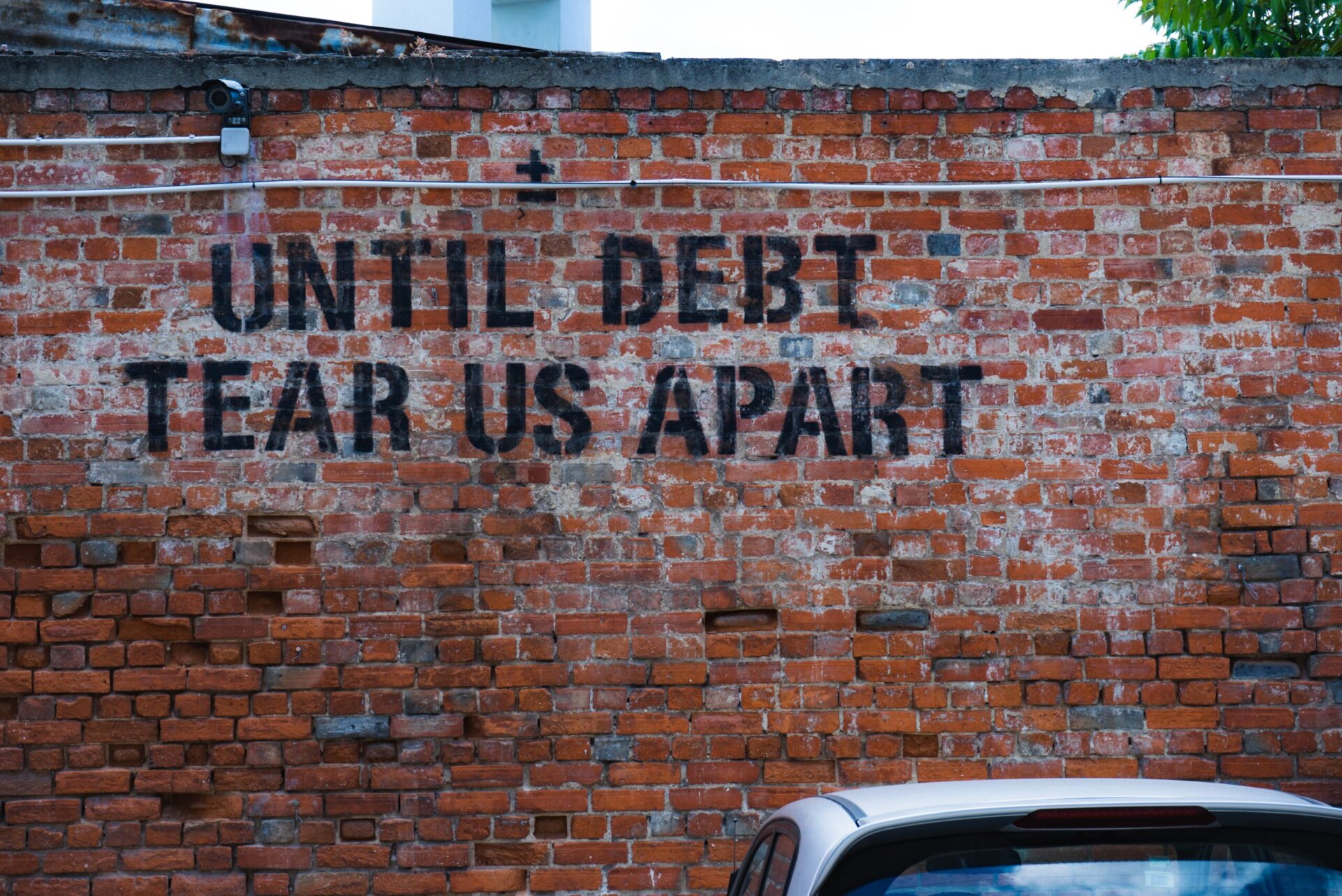

We are coming to the end of the biggest credit expansion in history. While the expansion of credit has been devaluing for the USD and inflationary in terms of policy action, reflected in higher food, housing, and other asset prices, the net force of technology, too much debt and aging demographics is ultimately deflationary in nature.

This deflationary pressure is what was really behind the issues of the 2008 housing bubble, and why economic growth has been below trend in the decade since. To be sure the actions of central banks have been to try and re-inflate the bubble, but it is a debt based bubble which ultimately wants to deflate.

However, COVID-19 has brought about unprecedented monetary policy, and when combined with ideas such as MMT and a move to address ever-growing wealth inequality, some experts in the financial space have stated they believe that we are now entering a new period of secular inflationary.

This article contains a list of the main arguments for and against, and well as some of the proponents of both sides.

Deflation

- Deflationary forces such as technology, too much debt, and aging demographics mean any inflation is only transitory.

- When the Fed does QE, it only gives commercial banks reserves, which are not spendable.

- The majority of money is created by commercial banks not the central banks of the world.

- Fiscal spending is only offsetting deflation occurring in the economy, and further socializing of the economy will only cause more deflation.

- While the money supply may be rising, the velocity of money is falling faster.

- We have not yet crossed the rubicon to debt monetization.

Inflation

- COVID has shown governments that deficits don’t matter, and so they will now have a much higher propensity to spend.

- Defacto or explicit MMT is already here, and we will see the Fed effectively monetizing debt at 0% interest rates.

- There is a cyclical nature to the US dollar, and we have entered a new dollar bear market.

- The Fed is printing money.

Deflation

Team Deflation

- Lacy Hunt

- Jim Rickards

- Raoul Pal

- Hugh Hendry

- Jeff Snyder

- Steven Van Metre

- Brent Johnson

- Jeffrey Gundlach (Short Term)

Team Inflation

- Kevin Muir

- Peter Schiff

- Julian Brigden

- Ben Melkman

- Lyn Alden

- Larry McDonald

- Luke Groman

- Jeffrey Gundlach (Long Term)

- Ray Dalio

- Stanley Druckenmiller

- Michael Howell

- Russell Napier